How Cybersecurity Helps Manage Risks in an Enterprise (Part 2)

In the modern business environment, where digital transformation is rampant and data is an invaluable asset, the repercussions of cybersecurity risks have become a pivotal concern for organizations. In Part 1 (see here) of this article, we explored the immediate technical challenges posed by data breaches, ransomware attacks, and system failures.

In this second part, we will explore further the other impacts of risks and consequences in an enterprise. The first one that comes to mind is the financial consequences, which can be devastating. Companies face not only the threat of direct monetary losses due to fines, compensation claims, and remediation costs but also an insidious erosion of their brand reputation and customer trust. The fallout from a cybersecurity incident can reverberate throughout an organization, affecting everything from stock valuations to customer retention and regulatory standing. Understanding these broad implications is essential for executives and decision-makers who must prioritize effective risk management strategies that shield their enterprises from not only financial damage but also the long-term impact on their reputation in a highly interconnected and competitive market. As we explore the financial and reputational stakes involved, it becomes clear that proactive cybersecurity measures are no longer optional but rather fundamental to sustaining business resilience and growth.

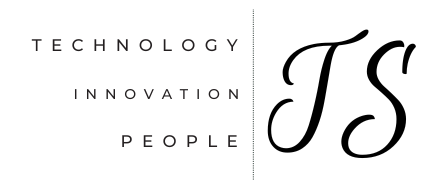

4. Financial Consequences of Cyber Incidents

The financial repercussions of cyber incidents are among the most immediate and tangible impacts that an organization can face. Cyber incidents can lead to substantial direct monetary losses through various avenues:

a. Direct Monetary Damage: Organizations must allocate significant budgets to manage the aftermath of a cyberattack. This includes expenses related to forensic investigations to determine the extent of the breach, remediation costs to repair systems, and potential legal fees associated with lawsuits from affected parties and regulatory investigations. For instance, data breaches can impose costs averaging around $3.86 million per incident related to data exfiltration, as noted in industry reports.

b. Operational Downtime: Cyberattacks such as Distributed Denial of Service (DDoS) attacks can cause operational downtime. Businesses experience revenue reductions as system outages hinder operations. Studies indicate that organizations can lose up to 10,000 USD for every minute of downtime. For larger corporations, this could translate into millions of dollars in lost revenue, while smaller businesses might incur costs starting at 100 per minute.

c. Liabilities from Data Breaches: When sensitive client data or intellectual property is compromised, organizations face significant financial liabilities. The costs associated with legal defences, customer compensation, and litigation can escalate rapidly. Beyond immediate costs, organizations might also face a loss in future business opportunities as clients may hesitate to engage with a compromised entity.

d. Productivity Losses: Recovery from a cyberattack often leads to decreased productivity. Employees may spend considerable time responding to the incident, managing fallout, and restoring systems to normal operations. Quantifying this impact in monetary terms can be complex, but the overall effect often leads to tangible financial loss and reduced efficiency.

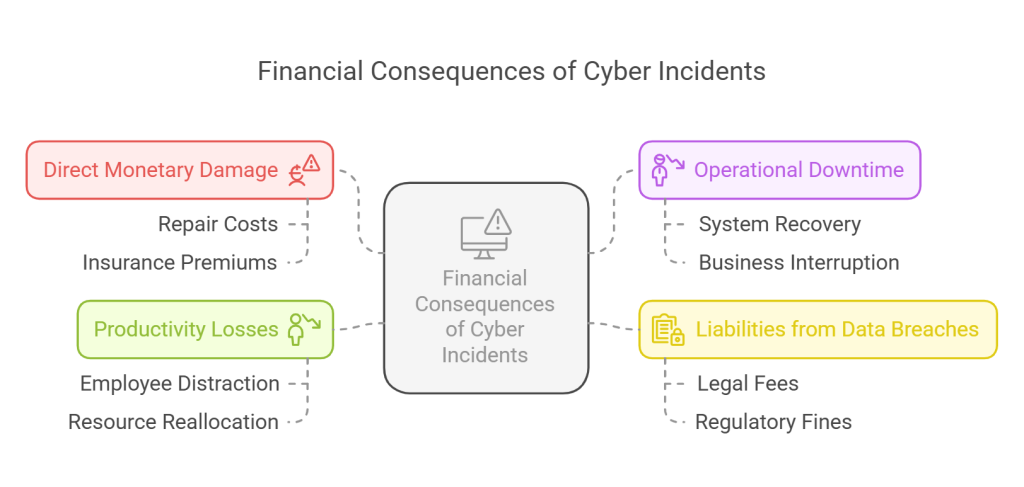

5. The Immeasurable Damage of Bad Reputation

In the realm of business, reputation serves as a valuable intangible asset that can be rapidly dismantled by a cyber incident:

a. Customer Trust Erosion: A cyber event can severely erode customer trust in an organization. Customers are increasingly cautious about sharing personal information, and any hint of inadequate cybersecurity can lead to a loss of loyalty and customer base. Research shows that following data breaches, companies often experience a decline in customer retention rates, which can have long-lasting implications on future profitability .

b. Brand Damage: Organizations suffering from cyber incidents may find their brand reputation severely tarnished. Negative media coverage can reduce investor confidence, impact market valuation, and deter potential customers from engaging with the brand. Many companies feel pressured to launch expensive public relations campaigns to recover public trust or may even undergo rebranding processes .

c. Ripple Effects on Third Parties: A breach can extend damage to associated third parties, compromising their security and reputational standing. Organizations often have to navigate the complex waters of liability and damages associated with breaches that affect partners, suppliers, or customers .

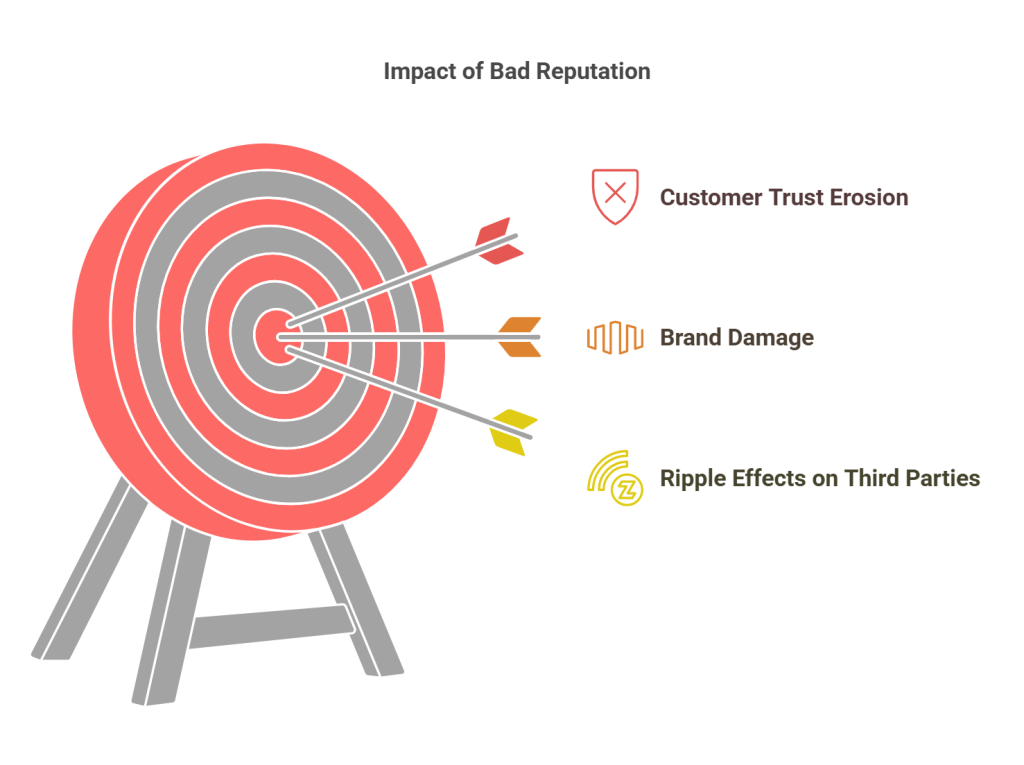

6. Penalties for Lack of Compliance to Regulations

Adherence to cybersecurity regulations is critical to avoiding punitive measures that can arise from non-compliance:

- Financial Penalties: Falling short of cybersecurity standards established by regulations such as GDPR, HIPAA, or PCI-DSS can lead to severe financial penalties. Non-compliance can result in fines that escalate into millions of dollars, negatively impacting an organization’s bottom line.

- Operational Restrictions: Beyond fines, organizations may face operational limitations imposed by regulatory bodies until compliance is resolved. This can hinder business operations and lead to reputational damage during the period of non-compliance.

- Legal Consequences: Non-compliance can also lead to legal repercussions, where affected parties seek damages against the organization for failing to secure personal data or comply with established guidelines. Such legal actions contribute further to financial strain and resource diversion from core business operations.

- Mandatory Remediations: Fines and penalties may require organizations to undergo mandatory corrective actions, including overhauling cybersecurity policies, investing in new technologies, and conducting extensive employee training. These requirements entail significant financial and operational investments.

Conclusion

As organizations navigate the intricate and multifaceted landscape of cybersecurity risks, it is crucial to recognize that the implications of these risks extend beyond immediate technical failures or data breaches. The financial consequences of cyber incidents can be staggering, often resulting in significant monetary losses that threaten not only the viability of the business but also its reputation and customer trust.

In addition to direct costs such as fines, legal fees, and remediation expenses, organizations must contend with the enduring impact of reputational damage that arises from publicized breaches and customer data compromises. Furthermore, the loss of trust can lead to diminished customer loyalty and reduced market competitiveness. Thus, it becomes apparent that an effective cybersecurity strategy must encompass a comprehensive approach to risk management that addresses both immediate and long-term effects.

Understanding these broad implications is essential for executives and decision-makers who must prioritize effective risk management strategies that shield their enterprises from not only financial damage but also the long-term impact on their reputation in a highly interconnected and competitive market. As we explore the financial and reputational stakes involved, it becomes clear that proactive cybersecurity measures are not optional but rather fundamental to sustaining business resilience and growth.

ACRONYMS used in the article are detailed below:

GDPR: General Data Protection Regulation. This is a European Union regulation focusing on the protection of personal data and setting guidelines for the collection and processing of personal information of individuals within the EU. The GDPR has a global impact, affecting any company that deals with the data of EU citizens.

CCPA: California Consumer Privacy Act. This is a state-level regulation focused on consumer data protection, requiring transparency in data practices.

NYDFS: New York Department of Financial Services. This is a New York state regulator that sets stringent cybersecurity requirements for financial services companies.

HIPAA: Health Insurance Portability and Accountability Act. This is a US federal law that requires security controls for personal health information and sets safeguard requirements that must be followed by health care providers, health plan providers, and health care clearinghouses.

PCI DSS: Payment Card Industry Data Security Standard. This is a set of security standards designed to ensure that all organisations that accept, process, store, or transmit credit card information maintain a secure environment. It aims to safeguard cardholder data and prevent credit card fraud. It is a contractual, not a regulatory requirement.

OCC: Office of the Comptroller of the Currency. This is an independent bureau within the US Department of the Treasury that regulates all national banks and federal savings associations. The OCC has the authority to enforce cybersecurity regulations and impose penalties on financial institutions that do not comply.

FDIC: Federal Deposit Insurance Corporation. This is an independent agency of the US federal government that preserves and promotes public confidence in the US financial system. The FDIC has enforcement authority over FDIC-insured banks and can penalize noncompliant behaviour, which can include significant fines.

CFPB: Consumer Financial Protection Bureau. This is a US government agency that is responsible for consumer protection in the financial sector. It focuses on data collection, use, and protection and issues fines and Consent Orders against noncompliant financial institutions.

=======================================

`Tosin Shobukola